- Playing For Doubles

- Posts

- I Call DIBS

I Call DIBS

A Potential Multibagger With Little To No Downside

If you like this article, please do share it with a friend. Thanks :)

If you’re new here, I am a fan of the Coffee Can Portfolio, an “Active Passive” approach to investing. The idea of a Coffee Can is simple: Buy a basket of the best stocks you can and let them sit for years. You incur no costs with such a portfolio, and it is simple to manage.

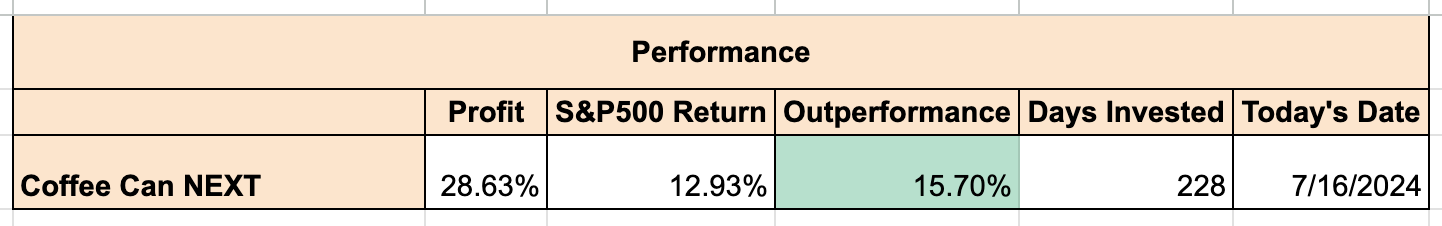

Here are the results of Coffee Can 12:

I Call DIBS

1stDibs.com Inc is a Stage 1 Maverick (i.e. A Disruptor). Disruptors are what I call companies who approach their industries in a completely new way. Why is that an important distinction? Because in business, every industry does things a certain way. These “industry conventions” are determined by the leaders of that industry. To prosper, innovative companies must therefore change the game entirely and create new ways of doing things. If they don’t, they will likely remain mediocre, at best.

1stDibs is bringing the world of luxury goods online. This is an extremely large global market that has very low online penetration, and one that has several “middle men” involved in the buying process. Of course, bringing such a market online isn’t easy (and is likely why it has taken the company over 20 years to get to where it is today), but if they pull it off, look out, this company could be a monster success. That should be an investor’s frame of mind, when approaching stocks like Venture Capital.

Disruptors have been staying private longer than they used to, so, as public market investors, having an opportunity to invest in them early has gotten difficult. $DIBS however is still small enough that it presents investors with true “venture scale” upside in the public markets.

Of course, at this stage in the business’ evolution, there may be multiple things that still need to be figured out, but then again, that’s why they’re considered “Stage 1”.

What I like about the business:

Price:

This business is extremely cheap:

~.6x EV/Sales

~2x Price/Sales

<1x EV/GP

~3x Price/GP

For roughly ~$50 million Enterprise Value (Note: The price has jumped up slightly since I started writing this piece),

We are getting a marketplace business doing $85 million in net revenues while selling over $350 million in annual gross merchandise value. That’s a tiny fraction of the overall market and they have less than 10,000 buyers currently. What does that tell you? They are just getting started.

We are getting a company for much less than what it would likely cost to build such a company from scratch today.

To give you a sense of how un-demanding this valuation is, the company just bought back $25 million of company stock. That’s equivalent to roughly half the entire EV!

The Business Model:

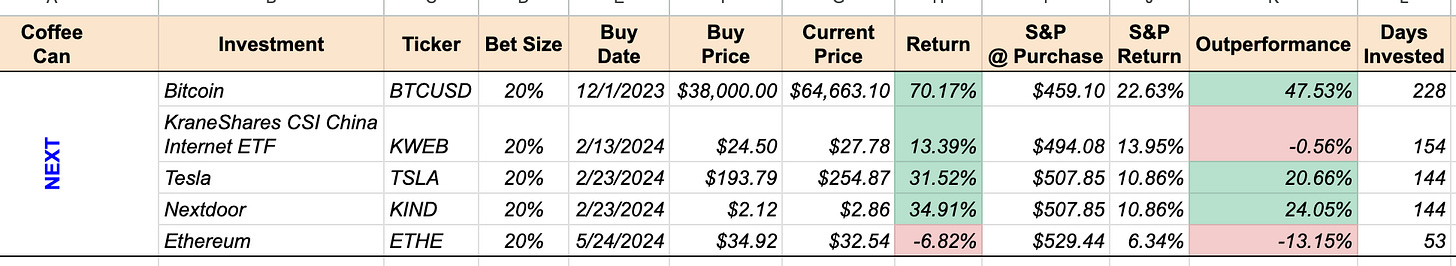

This is a high margin (72% currently) asset light 2-sided marketplace with the potential for strong network effects, a proven and coveted business model.

The CEO:

The company is run by David Rosenblatt, former CEO of DoubleClick, arguably Google’s most important and successful acquisition. I love CEOs who don’t need to work for money, and could be doing anything with their lives, yet they are working hard because the opportunity is meaningful to them.

If the company lives up to its potential and is successful in one day becoming a Stage 3 Maverick (i.e. A Leader), David should easily scale with the business.

Large Global Fragmented Market with Unexceptional Competition:

It goes without saying that this company is going after a very large global market.

It is also one where the incumbents have little tech prowess or capability since luxury transactions are largely a relationship driven offline business today.

Future Revenue Optionality:

The company has several future revenue opportunities it can tap into when the time is right.

And of course with network effects, their business should get stronger with time and size.

That said, with less than $1 Billion in annual GMV sales but a take rate already above 20%, the company has been pretty aggressive with pricing (in my opinion). I do wish the company did leave more latent pricing power in place during this phase of growth.

What Could Be Better?

Further Progress:

I do worry why the company isn’t further along. They have been at it since 2000 and first launched their eCommerce offering in 2013.

Brand:

Although the brand name is catchy, I am not convinced it’s what it needs to be long term. 1stDibs doesn’t really exude luxury…at least not to me.

A Little Old School:

Consumer buying behavior is changing. In particular, video and social media are becoming a big part of how people discover and engage with products and services. Therefore, it was a bit disappointing not to see video experiences front and center on their website. The experience does feel a little old school.

With only ~4000 TikTok followers, that has clearly not been a focus until recently. That said, Instagram does have almost 900K followers so that’s a good sign.

I’d like to see the company create more compelling consumer experiences.

I believe DIBS represents a highly asymmetric bet. The company trades for only a ~$180 million market cap. Why can’t this be a $2 Billion market cap company one day? It absolutely can if it continues to execute. Worst case, I don’t think we will lose money on this investment. There are too many good things here for a potential buyer (of which there could be many) not to pay at least the current price for the company’s assets, should it come to that. And I’m likely being conservative.

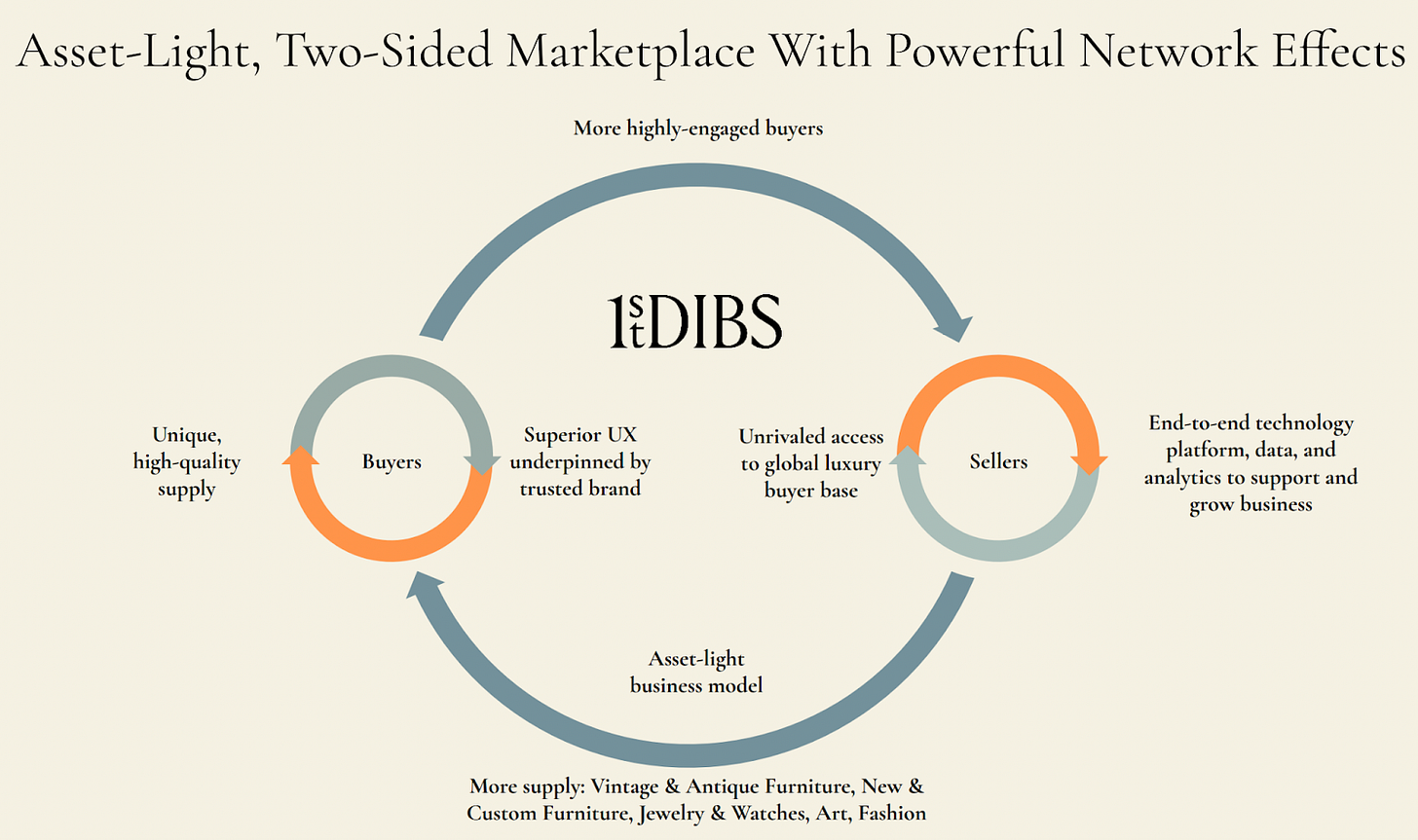

$DIBS is the first entry into our latest (13th) Coffee Can Portfolio:

Purchase Date: 7/12/2024

Purchase Price: $4.54/share

Thanks for reading Playing For Doubles!

Join 1768+ smart investors for free to receive new weekly posts and support my work.